Predictive analytics is transforming real estate by helping investors identify off-market properties before they hit the market. These deals make up about 10% of transactions and offer benefits like less competition, faster closings, and higher profit margins. By analyzing data such as market trends, property details, and seller behavior, predictive tools help investors:

- Spot properties with 25% higher returns.

- Reduce financial risks by 30%.

- Outperform the market by 15% over five years.

Key Points:

- What it does: Uses AI and data to predict which properties are likely to sell.

- Why it works: Combines property data, market trends, and owner behavior for accurate forecasts.

- How it helps: Identifies motivated sellers, zoning opportunities, and high-return investments.

Example: Blackstone used predictive analytics to acquire 80,000 undervalued homes, building a $20 billion portfolio.

Predictive analytics is a must-have for real estate professionals aiming to stay ahead in a competitive market.

Predictive Analytics Basics for Off-Market Properties

What Predictive Analytics Means in Real Estate

Predictive analytics in real estate brings together statistical methods, historical data, and machine learning to anticipate trends and uncover potential investment opportunities before they become publicly available. By analyzing past data, market movements, and homeowner behaviors, it predicts which properties are likely to be listed, giving investors a chance to close profitable deals and tap into emerging markets ahead of their competitors. For example, the accuracy of AI-powered models in estimating on-market home values has improved dramatically, with median error rates dropping from over 14% in 2006 to just 3.6% today. Properties identified using these advanced models not only yield 25% higher returns but also help reduce financial risks by as much as 30%. The foundation of these predictions lies in the diverse data inputs, which we’ll delve into next.

Data Sources for Predictive Models

To deliver accurate forecasts, predictive models draw on a wide range of data sources. The most effective models use a mix of property details, market trends, economic indicators, and demographic information.

| Data Category | Elements | Impact on Valuation |

|---|---|---|

| Property-Specific | Square footage, bedrooms, amenities | Directly affects property value |

| Market Data | Recent sales, listing prices, days on market | Reflects current market conditions |

| Economic Indicators | Employment rates, GDP growth | Highlights long-term value trends |

| Location Data | School ratings, crime rates, transit access | Influences neighborhood appeal |

| Social Factors | Population trends, demographic shifts | Signals future demand potential |

In addition to these traditional data sources, advanced models often incorporate unconventional variables. For instance, local amenities and even social media trends can help capture subtle shifts in property demand. When it comes to off-market deals, certain data points become especially important. Zoning regulations, for example, can highlight properties with development potential, while ownership records may reveal patterns in investor behavior. Similarly, financial distress indicators and municipal filings can point to motivated sellers before their properties are officially listed.

A practical example of this approach is AvalonBay Communities, which increased its revenue by 4.7% in 2022 by using AI to optimize rental pricing. These varied data inputs form the backbone of predictive analytics, enabling precise forecasts that are crucial for identifying off-market opportunities.

Why Predictive Analytics Works for Off-Market Deals

Predictive analytics is particularly effective for spotting off-market opportunities because it can analyze patterns in economic, demographic, and investor activity to predict changes in property demand, rental prices, and market appreciation. This is a game-changer, especially since only around 10% of home sellers find buyers without listing on the MLS.

Unlike traditional methods that rely solely on past sales data, predictive analytics combines a variety of factors - such as local economic conditions, property features, and market supply - to provide real-time, accurate valuations. What sets it apart is its ability to include future market forecasts, offering insights that conventional approaches often miss. This forward-looking perspective allows investors to identify high-return opportunities while steering clear of riskier areas.

The growing adoption of predictive analytics underscores its impact. In 2023, the AI-driven real estate market was valued at approximately $164.96 billion and is projected to reach $226.71 billion by 2024, with an impressive annual growth rate of 37.4%. By 2028, the market is expected to skyrocket to $731.59 billion. For commercial real estate professionals, these tools provide a clear path to focus their efforts on the most promising leads. Predictive analytics also helps identify high-intent buyers and sellers before they officially enter the market, giving investors a significant edge in securing profitable off-market deals.

Unlocking Predictive Analytics for Real Estate Success

Methods for Finding Off-Market Properties

Expanding on the earlier discussion about predictive models, this section dives into practical ways to use data and AI to uncover off-market properties. Predictive analytics has reshaped the traditional hunt for these properties, uncovering patterns that even seasoned investors might overlook. With advanced algorithms, it's possible to pinpoint motivated sellers, spot hidden development opportunities, and even predict an owner's likelihood of selling. Let’s break down how these tools work to identify motivated sellers, leverage zoning data, and analyze owner behavior for targeted outreach.

How Algorithms Identify Motivated Sellers

Today’s predictive algorithms are a game-changer for spotting motivated sellers. By analyzing thousands of data points, AI systems rank properties based on their likelihood of being sold off-market. These systems dig into financial distress signals, property tax records, and ownership trends to make their predictions. For example, they can estimate which homeowners are most likely to sell in the next six months by factoring in variables like how long they’ve owned the property, major life changes, or shifts in the market.

The results speak for themselves. Predictive analytics can achieve accuracy rates of 80–90% when flagging potential sellers. By evaluating signals like overdue taxes, foreclosure filings, divorce records, or estate settlements, these tools help investors zero in on properties that might come to market due to life circumstances, such as inheriting a home. This data-driven approach allows investors to focus on the most promising leads, boosting efficiency and improving the odds of finding great deals.

Using Zoning and Land Use Data

Zoning and land use data are often overlooked but incredibly useful for finding off-market opportunities. By analyzing zoning codes and land use plans, investors can uncover opportunities to repurpose properties - like converting office spaces into residential units. Many property owners don’t fully realize the development potential of their land, which creates a unique opening for savvy buyers.

"Zoning is one of the most overlooked - but absolutely critical - factors in commercial real estate investing."

– Lynna Paradiso, The Cauble Group

By studying zoning maps and regulations, investors can identify underused properties with untapped potential. For instance, properties with legal non-conforming uses or those that don’t fully align with their zoning entitlements may offer value-add opportunities. Cities like Los Angeles are prime examples, where zoning plans often indicate whether office-to-residential conversions are feasible.

A practical way to approach this is by using online GIS tools to search zoning details by parcel address, examine zoning overlays, and spot patterns that hint at future development. Combine this zoning data with ownership records, and you can pinpoint properties where the current use doesn’t maximize the land’s zoning potential. Platforms like Plotzy simplify this process, using AI to filter parcels based on zoning criteria and property details. Beyond zoning, understanding how owners behave can further refine your off-market strategies.

Predicting Owner Behavior for Direct Outreach

Predicting owner behavior is another critical piece of the off-market property puzzle. Advanced models analyze historical transactions, ownership durations, and demographic trends to identify the ideal time to approach homeowners. Some systems can even predict when an owner might consider selling before they’ve made any public moves .

Successful direct outreach goes beyond just financial data. While indicators like financial distress offer a starting point, predictive analytics enhances targeting by incorporating additional insights like social media activity, utility usage patterns, and building permit filings. For example, a recent permit for home improvements or a major life event might signal that an owner is preparing to sell.

sbb-itb-11d231f

AI Tools for Zoning and Property Research

AI is reshaping property research by building on predictive analytics and zoning data analysis. Today, 80% of real estate companies are leveraging AI, transforming how off-market research and property evaluations are conducted. This evolution underscores the growing role of AI in refining zoning research and property prospecting.

How AI Simplifies Zoning Research

AI takes the complexity out of zoning research by analyzing zoning regulations and filtering parcels based on permitted uses. These tools provide instant insights into zoning boundaries, allowable uses, and development restrictions across various properties.

One standout feature of AI technologies is their ability to automate zoning analysis. Users can input an address and receive multiple design and development options within seconds. This eliminates the need for time-consuming manual work, enabling investors to quickly assess the development potential of off-market properties.

"Good urban planning reflects a community's values through its built environment, a human-centered process AI cannot replace. However, AI enhances planning by modeling future spaces and analyzing costs with speed and precision."

– Christopher A. Watson, Director of Planning and Development Services at Murphy Schiller & Wilkes LLP

AI also identifies properties that underutilize their zoning potential, highlighting opportunities for redevelopment or upzoning. This capability is particularly valuable in competitive markets where maximizing property value is crucial.

Advanced Property Prospecting Methods

AI has transformed property prospecting into a streamlined, data-driven process. Instead of manually gathering information, AI automates data collection and organizes it into actionable insights. This includes instant access to ownership details and comprehensive property reports.

By analyzing a wide range of data - such as local market trends, demographic shifts, consumer spending patterns, comparable sales, and neighborhood amenities - AI uncovers off-market opportunities that might otherwise go unnoticed. Platforms like Plotzy exemplify these advancements by integrating these capabilities into a single, user-friendly tool.

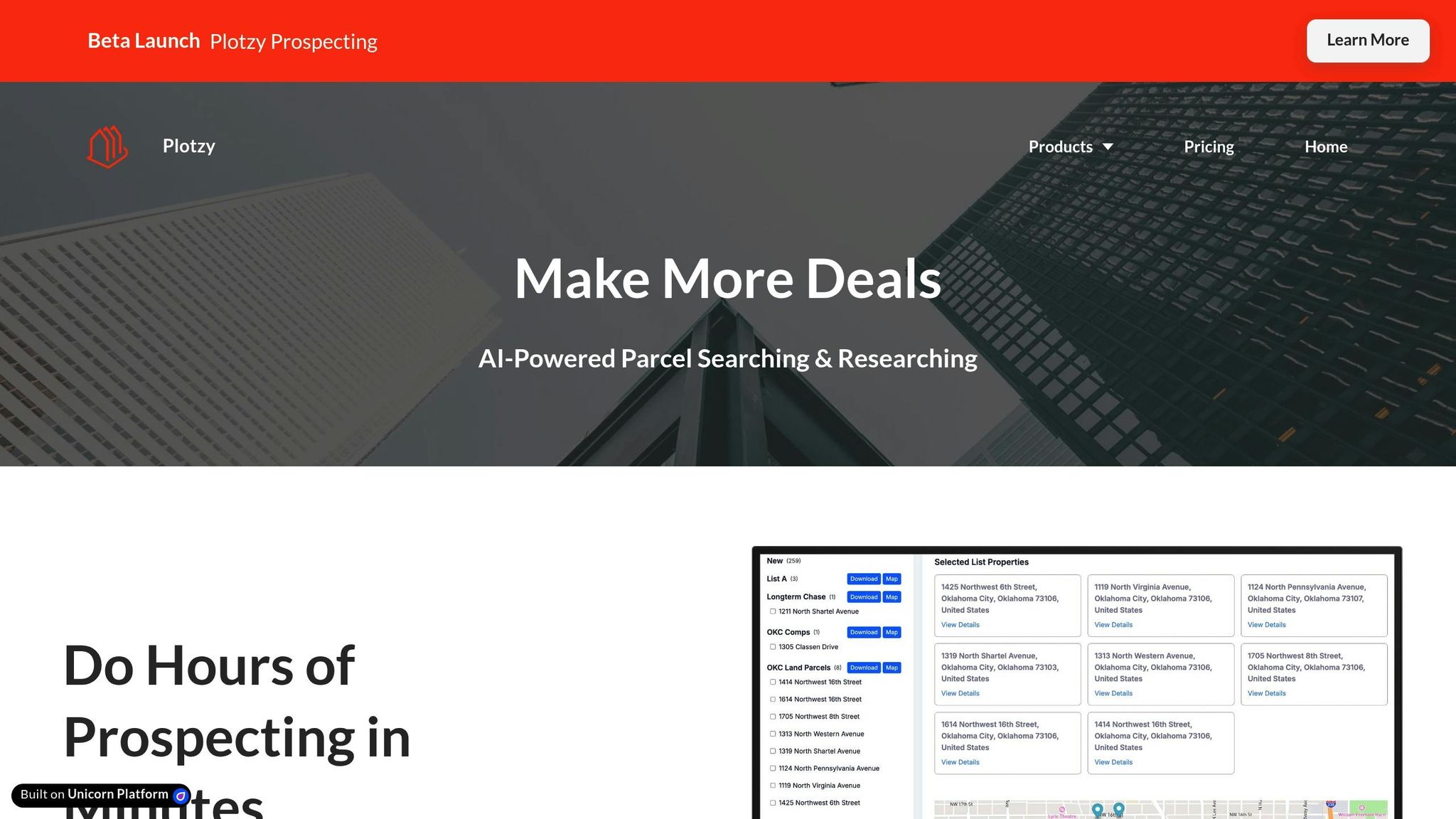

Case Example: Using Plotzy for Off-Market Research

Plotzy demonstrates how AI-powered platforms can revolutionize off-market property research. Users can filter and search for parcels based on zoning and other criteria, pinpointing opportunities that align with their investment strategies. The platform consolidates data from multiple sources, providing access to owner contact details and generating detailed property reports - all in record time.

One of Plotzy's standout features is its ability to interpret zoning codes to identify properties not fully utilizing their zoning potential. This is especially useful in markets where conversions, such as turning office spaces into residential units, are viable options.

For $200 per month, Plotzy's Pro plan offers robust features, including unlimited property searches, zoning answers, parcel filtering by permitted use, and access to owner contact information. Real estate teams using such tools gain a competitive edge, as they can identify off-market opportunities faster and more efficiently.

With the AI real estate market projected to reach $33.03 billion by 2027, platforms like Plotzy are paving the way for the future of commercial real estate research. These tools empower professionals to uncover opportunities with unmatched speed and accuracy, setting a new standard for property prospecting.

Best Practices for Using Predictive Analytics

Predictive analytics can be a game-changer for uncovering off-market opportunities, but its success hinges on thoughtful integration, accurate data, and a commitment to ongoing improvement. Let’s break down some best practices to make the most of these tools.

Connecting Predictive Tools with Existing Systems

For predictive analytics to deliver value, it needs to work seamlessly with the systems you’re already using. By integrating it with tools like CRM software, property management platforms, GIS systems, and mobile applications, you can enable real-time, data-driven decision-making.

Start by identifying specific business challenges that predictive analytics can address. Then, implement tools gradually, ensuring strong data governance throughout the process. Measuring results at each step is key to refining your approach. These integrations not only enhance functionality but also help maintain data integrity - a foundation for effective predictive analytics.

Checking Data Accuracy and Model Performance

The success of predictive analytics depends heavily on the quality of your data and the performance of your models. Machine learning algorithms are constantly improving accuracy; for instance, the median error rate for on-market homes stood at about 3.6% in 2023. However, this level of precision requires rigorous data management.

To ensure accuracy, standardize data entry practices by using consistent formats, terminology, and validation rules. Cross-check property details - like square footage, lot size, and number of bedrooms - against reliable sources such as MLS databases or county records. When verifying transaction details, compare sales prices, dates, and involved parties with official county documents, transfer tax records, and title data.

Outliers can skew your models, so use statistical techniques like the median absolute deviation or Hampel identifier to identify and address anomalies. Geospatial accuracy is equally important; validate property coordinates using authoritative datasets or field surveys. Automated data consistency checks, coupled with clear governance and documentation practices, can further minimize errors. Accurate data is the backbone of any predictive analytics initiative.

Building a Continuous Learning System

Once your systems are integrated and your data is reliable, the next step is to establish a continuous learning framework. This allows predictive models to improve over time by learning from new data. Unlike traditional programming, continuous learning enables AI systems to adapt without losing prior knowledge.

For example, AvalonBay Communities used predictive analytics to fine-tune rental pricing, boosting revenue by 4.7% without significantly impacting occupancy rates.

"The fusion of continuous learning in AI with strategic digital marketing practices can unlock profound benefits for SMEs, enabling real-time adaptability and informed decision-making that aligns with ever-changing consumer behavior." – Stephen McClelland, ProfileTree's Digital Strategist

To maintain and enhance predictive accuracy, implement rapid feedback loops and invest in ongoing professional development for your team. Predictive models, when properly managed, have been shown to deliver up to 25% higher returns and outperform the market by 15% over a five-year span. Establish clear protocols for data collection, validation, and upkeep. Additionally, pairing data scientists with real estate professionals can provide the necessary expertise to refine and interpret models effectively.

Conclusion: The Potential of Predictive Analytics for Off-Market Deals

Predictive analytics is changing the way commercial real estate professionals uncover off-market opportunities. By digging into massive datasets to predict trends and pinpoint potential sellers before properties hit the market, this technology achieves what traditional methods often cannot. The results speak for themselves, with measurable advantages rippling across the industry.

For instance, predictive analytics has been shown to deliver 25% higher returns and outperform market averages by around 15% over five years.

"Predictive analytics helps surface potentially profitable properties earlier by using data from past investor activity, market trends, and property‑level insights. It's like having an inside track into where a local real estate market is going next." – Privy

This technology doesn’t just uncover hidden gems - it reduces risk significantly. Asset managers and real estate firms using big data analytics have cut risk by 30%, and for every dollar invested in analytics, they see an average return of $13.

The success stories are compelling. Take Blackstone’s Invitation Homes as an example. After the 2008 housing crisis, Blackstone used predictive analytics to identify undervalued single-family homes. The result? They acquired around 80,000 properties, forming a REIT worth over $20 billion. This allowed them to analyze thousands of properties daily and make quick, informed buying decisions.

The momentum for AI-driven tools in real estate is undeniable. In 2023, $630 million was poured into AI-powered proptech, and the AI-driven real estate market is expected to hit $731.59 billion by 2028. Additionally, 89% of organizations believe that AI and machine learning will be key to boosting revenue, streamlining operations, and enhancing customer experiences.

For commercial real estate professionals, adopting predictive analytics is becoming less of an option and more of a necessity. It allows them to spot motivated sellers early, establish connections before competitors, and secure listings in a fiercely competitive market. Importantly, this technology doesn’t replace expertise - it strengthens it, equipping professionals with the insight needed to make smarter, faster decisions.

Companies like Plotzy are leading the charge, offering tools like AI-powered zoning analysis, owner contact information, and detailed property reports. These advancements are shaping the future of off-market deal sourcing, making it more efficient and data-driven than ever before.

FAQs

How can predictive analytics help uncover off-market real estate opportunities before they hit the market?

Predictive analytics gives real estate professionals a way to spot off-market opportunities by digging into historical data, market trends, and property-specific indicators. It helps identify property owners who might be more inclined to sell, based on factors like changes in ownership, property features, or evolving neighborhood dynamics.

With the help of AI-driven tools, brokers, investors, and developers can pinpoint properties that could soon hit the market. These tools also evaluate the potential worth and feasibility of these properties, making it easier to make informed, strategic investment choices. By simplifying the search for hidden opportunities, predictive analytics not only saves time but also provides a clear competitive advantage.

What key data is essential for building predictive models in real estate, and how does it guide investment decisions?

Effective predictive models in real estate rely on a mix of essential data sources such as historical sales records, market trends, demographic details, and economic indicators. For instance, historical sales data can shed light on property value trends by examining past market behavior. Meanwhile, market trends help pinpoint areas with growth potential or highlight neighborhoods that may pose risks. Demographic insights, like shifts in population or changes in income levels, often signal demand, and economic indicators - such as employment rates - offer a snapshot of the market's overall stability.

When these data points are combined, they provide investors with a clearer picture of off-market opportunities, potential property value changes, and up-and-coming markets. Predictive analytics equips investors to make smarter, informed decisions that align with the current market landscape, ultimately helping to maximize returns.

How can AI-powered tools help real estate professionals find off-market opportunities and stay ahead in the market?

AI-driven tools are transforming the way real estate professionals discover and assess off-market opportunities. These tools sift through massive datasets to highlight potential deals that might otherwise slip under the radar, cutting down on time and effort. By automating tasks like prospecting, researching properties, and retrieving owner contact details, AI frees up professionals to concentrate on strategic decisions and building client relationships.

With capabilities like advanced filtering based on zoning or specific property criteria, these tools make site selection and investment analysis more efficient. This helps users zero in on promising opportunities quickly, boosting productivity and giving them a competitive edge in the fast-moving world of commercial real estate.