Machine learning (ML) is transforming real estate investment in 2024. Here's what you need to know:

- ML crunches massive data to spot trends humans might miss

- It makes more accurate predictions about property values and market moves

- ML automates tasks, saving time and reducing errors

- It helps manage risk by flagging issues and fine-tuning portfolios

Key ML methods in real estate:

| Algorithm | Purpose | Real Estate Application |

|---|---|---|

| LASSO | Identifies important factors | Determines property value drivers |

| K-Means Clustering | Groups similar items | Sorts properties by market type |

| Hierarchical Clustering | Creates nested groups | Spots neighborhood trends |

| Neural Networks | Mimics brain processing | Predicts prices and market shifts |

This guide covers:

- Data reduction techniques

- Market segmentation with ML

- Setting up ML systems

- Evaluating and improving results

- Software tools for ML in real estate

ML is set to be the biggest game-changer for investment pros in the next decade. Learn how to leverage it for smarter real estate decisions and better returns.

Related video from YouTube

Data Reduction Methods

Real estate asset allocation involves tons of data. It's a lot to handle. That's where data reduction methods come in. They help simplify your analysis and make better decisions.

Using PCA for Data Analysis

Principal Component Analysis (PCA) is a go-to tool for simplifying real estate data. It spots patterns and cuts down variables while keeping the important stuff.

Here's how PCA helps in real estate:

- It makes property comparisons easier by combining features like size, bedrooms, and location into simpler components.

- It shows you what really drives the market by highlighting the most important features.

- It helps you see trends better by reducing the number of dimensions.

Picking the Right Data Points

Not all data matters equally. You need to choose wisely:

1. Focus on what matters

Pick data that actually affects property values and market trends.

2. Avoid repetition

Don't use data points that tell you the same thing.

3. Think ahead

Include data that helps predict future market moves, not just current conditions.

| Data Type | Importance | Examples |

|---|---|---|

| Property-specific | High | Size, age, amenities |

| Location-based | High | Neighborhood stats, school ratings |

| Economic indicators | Medium | Local job growth, interest rates |

| Market sentiment | Medium | Consumer confidence index |

Data Reduction Methods Compared

Let's look at some popular data reduction techniques:

| Method | Pros | Cons | Best For |

|---|---|---|---|

| PCA | Keeps variance, handles big datasets | Can be tricky to understand | General data simplification |

| Factor Analysis | Finds hidden variables | Assumes straight-line relationships | Uncovering hidden market factors |

| LASSO | Picks out key features | Might oversimplify complex stuff | Finding main value drivers |

"Cutting down data variables makes things simpler but can make your model less accurate. But with fewer features, it's easier to explore, see, and analyze. It also makes your algorithms run faster." - Data Science Expert

When using these methods on real estate data:

- Make sure all your data is on the same scale before you start.

- Double-check your simplified data against the full set to make sure you're not losing anything important.

- Keep tweaking your approach. Try different methods and combinations until you get it right.

Finding Market Groups with ML

Machine learning (ML) is changing how real estate pros spot and analyze market segments. It uses smart algorithms to find hidden patterns and group similar properties better than ever.

Grouping Similar Properties

Clustering algorithms are the key to grouping properties with ML. They sort properties into categories based on shared features. Here's how it works:

- Gather property data (location, price, size, amenities)

- Pick the most important features for grouping

- Choose a clustering algorithm (K-means is popular)

- Train the model on your data

- Check the results and tweak as needed

Real-world example: Redfin used ML to analyze 500,000+ home sales in the US. Their algorithm found distinct "home styles" based on features like size and architecture. This made their price predictions 12% more accurate than old methods.

| Home Style | Features | Avg. Price |

|---|---|---|

| Urban Condos | Small, city center | $450,000 |

| Suburban Homes | Medium, good schools | $650,000 |

| Luxury Estates | Large, high-end perks | $2,100,000 |

Location and Population Analysis

Location is key in real estate, and ML is great at finding geographic patterns. Here's how to use ML for location-based grouping:

- Mix property data with location info (income levels, crime stats, etc.)

- Use spatial clustering to group properties by location and shared traits

- Look at population trends to spot up-and-coming areas

Zillow's "Neighborhood Trends" feature is a good example. It uses ML to analyze data from 7,500 US neighborhoods, grouping them based on things like home value growth and rental income.

| Neighborhood Type | Features | Investment Potential |

|---|---|---|

| Up-and-Coming | Fast price growth, young crowd | High |

| Stable Suburbs | Steady prices, family-friendly | Medium |

| Changing Urban | Shifting demographics, rising values | High but risky |

Using these ML insights, investors can make smarter choices. A cautious investor might go for "Stable Suburbs", while someone after bigger returns could target "Up-and-Coming" areas.

sbb-itb-11d231f

Setting Up ML Systems

Let's dive into setting up machine learning (ML) systems for real estate asset allocation. It's not rocket science, but it does need some careful planning.

Getting and Cleaning Data

First things first: data. You can't make a cake without ingredients, and you can't build an ML system without data. Here's where to look:

- Public records (property details, tax stuff)

- Online platforms (think Zillow or Trulia)

- Market reports (economic indicators, who's living where)

- Proprietary databases (past sales, what people are paying in rent)

But raw data is messy. You need to clean it up:

- Kick out the weird stuff (like that $10 million mansion in a $300k neighborhood)

- Fill in the blanks (use averages or most common values)

- Make everything match (dates, measurements, you name it)

Here's a quick look at how to clean your data:

| What to Do | How to Do It | Example |

|---|---|---|

| Remove outliers | Toss out anything way off the average | That mansion we talked about? Gone. |

| Fill in missing info | Use averages for numbers, most common for categories | No square footage? Use the average of similar homes. |

| Make formats match | Pick a format and stick to it | All dates become YYYY-MM-DD |

Picking and Testing ML Models

Now, what kind of ML model do you need? It depends on what you're after:

- Linear Regression: Good for simple "if this, then that" predictions

- Random Forest: When things get complicated

- K-Means Clustering: For grouping similar stuff together

Testing your model is crucial. Here's the gist:

- Split your data (70-80% for training, the rest for testing)

- Train your model on the bigger chunk

- See how it does with the leftover data

Here's a real-world example: A Philly real estate firm teamed up with an AI company, built a custom ML system, and landed a $26 million deal. Not too shabby.

Setup Steps

Ready to get your hands dirty? Follow these steps:

1. Know what you want

Figure out your goals. Maybe you want to:

- Predict property values really accurately

- Find hidden gems in certain markets

- Make your portfolio work harder for you

2. Get your data ducks in a row

Set up systems to:

- Gather data from all over

- Clean it up

- Create useful new data points

3. Pick your tools

Choose your weapons:

- Python with scikit-learn for most jobs

- TensorFlow or PyTorch if you're feeling fancy

- Cloud platforms like AWS or Google if you need serious muscle

4. Build and train

Start simple, then ramp up the complexity as you go.

5. Check and double-check

Make sure your model works on data it hasn't seen before. Keep tweaking as you go.

6. Play nice with others

Make your ML system talk to your other real estate tools.

7. Keep an eye on things

Check in on your model regularly. Retrain it when the market shifts.

"Predictive analytics in real estate can be a game-changer, but you've got to do it right." - Matellio Inc.

There you have it. Setting up ML systems for real estate isn't a walk in the park, but it's not impossible either. With the right approach, you could be making smarter, data-driven decisions in no time.

Checking and Improving Results

You've set up your ML system for real estate asset allocation. Great! But your job isn't done. You need to keep tabs on its performance and fine-tune it. Here's how:

Success Measurements

To gauge your ML model's performance, you need to measure it. Here are some key metrics:

| Metric | What It Measures | Why It's Important |

|---|---|---|

| Mean Absolute Error (MAE) | Average gap between predicted and actual values | Shows prediction accuracy |

| Root Mean Squared Error (RMSE) | Like MAE, but hits big errors harder | Helps spot major prediction fails |

| R² (Coefficient of Determination) | How much of the data variance your model explains | Indicates model fit |

But don't just trust the numbers. Look at real-world performance too:

- Does it work on new data?

- Are its predictions consistent over time?

- Do its predictions match market reality?

A model that looks good on paper but flops in practice? Not worth much.

"The generalization error shows how well the model performs on new, unseen data." - IntelliSync AI

To avoid overfitting (when your model aces training data but bombs on new stuff), try these:

1. Holdout validation

Keep some data as a test set. Train on the rest, then see how it does on this "new" data.

2. Cross-validation

Split your data into chunks. Train and test on different combos for a better performance estimate.

3. Regular retraining

Markets change. Keep your model fresh with new data.

Making Portfolio Changes

Your ML model's spitting out insights. Now what? Here's how to act on them:

1. Start small

Don't overhaul everything based on ML predictions right away. Test the waters first.

2. Set clear rules

Decide when to make changes. Maybe only rebalance if the predicted return difference tops 5%.

3. Factor in costs

Sometimes, a small predicted gain isn't worth the trading costs. Keep this in mind.

4. Gradual shifts

Instead of big changes all at once, shift your portfolio over time. It can help cut risk.

Here's a real-world example:

PanAgora Asset Management uses ML to tweak its equity strategies. They've found that by adjusting allocations dynamically, they can cut risk and boost returns without excessive trading. Their approach:

- Constantly monitor market data

- Adjust in real-time based on AI predictions

- Balance risk and performance based on investor needs

The result? PanAgora's consistently outperformed traditional methods, especially when markets get wild.

Software and Programs

Let's look at some tools that can boost your real estate investment game with machine learning.

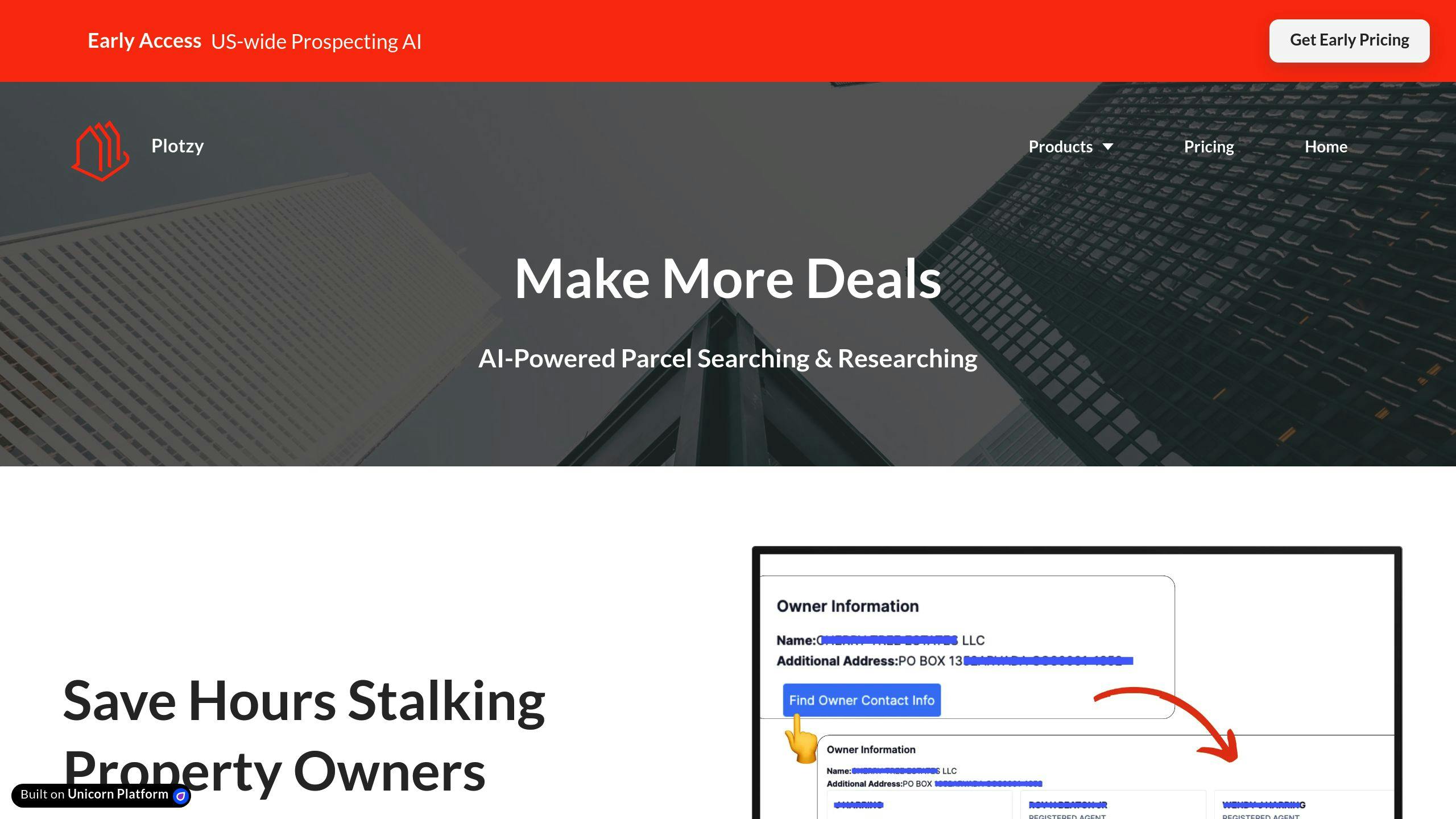

Plotzy: AI-Powered Property Analysis

Plotzy is built for commercial real estate pros. Here's what it offers:

| Feature | What It Does |

|---|---|

| AI parcel search | Finds properties that fit your needs |

| Zoning info | Shows local rules quickly |

| Owner contacts | Makes reaching out easier |

| Property reports | Gives you the full picture |

For $200 a month, you get unlimited searches, instant zoning info, and smart filters. It's great for brokers, developers, and land buyers who want to use AI.

Other ML Tools for Real Estate

While Plotzy focuses on property research, these tools help with the number-crunching side:

1. RealData

RealData is all about investment analysis. For $85 a month, you can:

- Check out rental properties

- Guess how much a property might go up in value

- Look at important investment numbers

This one's $30 a month for the basic plan. It lets you:

- See how investments did in the past

- Guess how they might do in the future

- Do some fancy portfolio math

3. Kubera

For $199 a year, Kubera helps you:

- Keep an eye on all your money stuff

- See how your portfolio holds up in tough times

- Figure out what makes your real estate investments tick

How They Stack Up

Here's a quick look at how these tools compare:

| Tool | What It's For | ML Stuff It Does | How Much It Costs |

|---|---|---|---|

| Plotzy | Finding and checking out properties | Smart searching and sorting | $200/month |

| RealData | Figuring out if an investment is good | Making financial models | From $85/month |

| Portfolio Visualizer | Looking at your whole investment picture | Guessing future performance | From $30/month |

| Kubera | Keeping track of all your money | Testing how tough your portfolio is | $199/year |

Each tool has its own strengths. Plotzy is great for finding properties, RealData helps you crunch the numbers, Portfolio Visualizer digs deep into your investments, and Kubera gives you the big picture.

"Picking the right software can make or break a real estate investor's efficiency and profits." - Yana Yarotska, Proptech Fan

The best tool for you depends on what you need and how you invest. Try out the free versions if you can before you buy.

Summary

Machine learning (ML) is changing how we handle real estate asset allocation. It's giving investors new ways to make smart choices and get the most out of their portfolios. Here's what you need to know:

ML is shaking things up in real estate. It's being used for everything from figuring out property values to managing portfolios. In fact, investment pros think ML will be the biggest game-changer in their jobs over the next 5-10 years.

Data is key, but there's often too much of it. That's where techniques like Principal Component Analysis come in. They help boil down complex real estate data into something more manageable.

ML is also making market segmentation smarter. It can group similar properties and analyze locations better than old-school methods. Redfin, for example, used ML to look at over 500,000 home sales. This helped them improve their price predictions by 12%.

Setting up ML systems isn't a walk in the park. You need to plan carefully, from collecting data to picking the right model. And don't forget - you'll need to retrain your models as markets change.

Keep an eye on how your ML model is doing. Use metrics like Mean Absolute Error and Root Mean Squared Error. PanAgora Asset Management found that tweaking allocations based on AI predictions can boost returns and lower risk.

The right tools can make a big difference. Whether it's Plotzy's AI-powered property analysis or Portfolio Visualizer's investment modeling, pick tools that fit what you're trying to do.

Looking ahead, ML in real estate is only going to get bigger. S&P Global Ratings thinks AI will play a bigger role in real estate companies' credit quality in the next 5-10 years.

Want to stay ahead of the curve? Here's what you can do:

- Get your team up to speed on ML

- Team up with tech providers or AI startups

- Start small with ML and grow from there

- Keep an eye out for new trends like advanced image recognition and smart contracts