AI is transforming how real estate contracts are analyzed, making the process faster, more accurate, and less prone to human error. By using tools like machine learning and natural language processing, AI can identify risks such as zoning conflicts, missing terms, financial liabilities, and compliance issues. It processes documents quickly, extracts key clauses, scores risks, and generates detailed reports that help professionals make informed decisions.

Key takeaways:

- Why it matters: Real estate contracts are complex and errors in manual reviews can lead to costly disputes or delays.

- AI's role: AI speeds up the review process by 75%, reduces errors, and enhances compliance with laws.

- Steps involved: AI digitizes contracts, extracts clauses, scores risks, and creates actionable reports.

- Tools like Plotzy: Platforms like Plotzy simplify property research by verifying zoning, ownership, and municipal records.

For real estate professionals, AI offers a smarter way to assess risks and ensure smoother transactions while addressing data security and compliance challenges.

Real Estate AI: Turn 30-Minute Contract Setup Into 3-Minute Reviews | Transaction Management

Key Steps in AI-Driven Contract Risk Analysis

AI transforms the way contracts are reviewed by converting complex documents into structured data for risk assessment. This approach streamlines traditional processes, making it easier to identify and act on potential risks. Each step in this process builds on the last, creating a clear path from document digitization to actionable insights.

Step 1: Data Ingestion and Digitization

The process begins with digitizing contracts to prepare them for AI analysis. Using intelligent document processing (IDP), AI can handle real estate paperwork efficiently by ingesting documents from sources like emails, scanners, or cloud storage. It supports various formats, including PDFs, scanned images, and digital forms. For physical documents, Optical Character Recognition (OCR) converts paper contracts into machine-readable formats. Preprocessing steps like noise reduction, image correction, and text extraction ensure the data is clean and ready for the next stage.

Take Sunshine Title Solutions in Florida as an example. By adopting AI, the company cut processing times by 42%, reduced errors by 33%, and lowered costs by 28%. AI's ability to extract data up to four times faster than manual methods is a game-changer, especially considering that document management issues can account for 21.3% of productivity losses.

Step 2: Automated Clause Extraction

Once digitized, AI uses machine learning to extract and classify key provisions, such as termination clauses, indemnification terms, and exclusivity agreements. It also identifies important details like dates and governing laws. Unlike basic keyword searches, AI understands concepts and converts clauses into structured data, offering insights like whether a license is exclusive or if assignment requires consent.

For instance, Jones Lang LaSalle (JLL) employs AI with natural language processing to extract critical details from lease agreements, such as clauses, payment schedules, and tenant obligations. This approach significantly reduces review times and legal expenses. In one study, AI reviewed non-disclosure agreements (NDAs) with 94% accuracy, outperforming experienced lawyers who achieved 85% accuracy.

Step 3: Risk Scoring and Cross-Referencing

After extracting clauses, AI assigns risk scores by analyzing multiple factors to create a comprehensive risk profile. This scoring system helps prioritize risks by evaluating their severity and likelihood.

AI also cross-references contract clauses with zoning laws and municipal codes to detect compliance issues. It identifies potential liabilities and evaluates financial risks by analyzing market trends and financial statements. For example, a lender worked with JLL Risk Advisory to use AI-driven valuation models for monitoring a $7 billion real estate portfolio. The AI flagged 10–15% of properties for further human review, leading to reduced risks and cost savings.

Step 4: Creating Risk Assessment Reports

In the final step, AI generates real-time reports that highlight inconsistencies, fraud risks, and compliance issues. These reports often include detailed risk profiles, severity rankings, and recommended actions.

For example, Sunshine Title Solutions used AI to flag anomalies in title records, reducing overlooked liens by 25% within six months. These reports not only improve transparency but also support regulatory compliance, reinforcing the benefits of earlier risk assessments.

"Potential risks in leveraging AI for real estate aren't barricades, but rather steppingstones. With agility, quick adaptation, and partnership with trusted experts, we convert these risks into opportunities." - Yao Morin, Chief Technology Officer, JLLT

Common Risks AI Detects in Real Estate Contracts

AI systems are particularly good at identifying patterns and inconsistencies that might slip past human reviewers, especially when dealing with a large number of contracts. These tools can flag risks in various areas, ranging from compliance with regulations to financial concerns that could affect property investments.

Zoning and Land Use Non-Compliance

When it comes to zoning violations, AI simplifies a traditionally complex process. By analyzing intricate zoning codes and comparing them with contract terms, AI can quickly highlight potential compliance issues and suggest ways to align agreements with the law. It even uses geo-data analysis to spot violations and improve land-use compliance.

A real-world example of this is the Steel Tech redevelopment project in Jersey City, New Jersey. This project, which spans 3.3 acres of a former industrial site, is being transformed into a mixed-use complex. AI tools, combined with virtual reality and 3D rendering, have been instrumental in planning and visualizing the development. The project includes a residential tower, business incubator spaces, public areas, and a pedestrian mall, all while focusing on affordable housing and opportunities for minority-, women-, and veteran-owned businesses.

"Good urban planning reflects a community's values through its built environment, a human-centered process AI cannot replace. However, AI enhances planning by modeling future spaces and analyzing costs with speed and precision. It brings predictability to real estate development while preserving the vital role of human insight. As a tool, AI complements planners, enabling them to shape spaces that truly serve their communities." - Christopher A. Watson, Director of Planning and Development Services at Murphy Schiller & Wilkes LLP

AI also helps identify rezoning risks by analyzing urban planning documents, environmental impact reports, and municipal policies.

Missing or Unclear Contract Terms

AI is a powerful tool for spotting ambiguous or missing contract terms that could lead to legal or financial trouble. It flags unclear language, contradictory clauses, and deviations from standard practices or regulations. For instance, during testing, AI identified 94% of loopholes in contracts, outperforming human reviewers, who achieved 85% accuracy.

The technology also ensures no critical details are overlooked. For example, it can flag missing security deposit information in lease agreements, which might otherwise cause legal headaches. By automating these tasks, AI can speed up contract reviews by as much as 85%, freeing legal teams to focus on more strategic negotiations.

Financial Risks and Liabilities

AI is adept at identifying financial risks that could affect investment returns or lead to unexpected liabilities. It evaluates payment terms, uncovers hidden costs, and assesses financial structures within contracts. For example, AI can monitor corporate filings, bond ratings, and earnings reports to detect signs of financial distress early on.

Natural language processing algorithms also allow AI to analyze lease agreements for missing or unfavorable clauses that could pose risks. These insights help create a clearer picture of potential financial challenges.

Data Gaps in Owner or Municipal Research

Incomplete or outdated data can create blind spots in real estate contracts, potentially derailing transactions. AI helps by identifying missing information and flagging areas that need further investigation. For instance, it can detect gaps in ownership records, such as missing contact details or inconsistencies that could indicate recent transfers or complex ownership structures.

AI also compares contract descriptions with official zoning classifications, highlighting discrepancies that need to be resolved before closing. This ensures a more reliable and complete understanding of the property and its associated risks.

AI Tools for Real Estate Contract Analysis

AI-powered platforms are transforming how legal documents are handled, turning dense contracts into actionable insights. These tools leverage advanced algorithms to process complicated legal documents, extracting critical details that manual reviews might overlook. By integrating with broader AI-driven risk analysis systems, they provide a more efficient and accurate way to assess contracts.

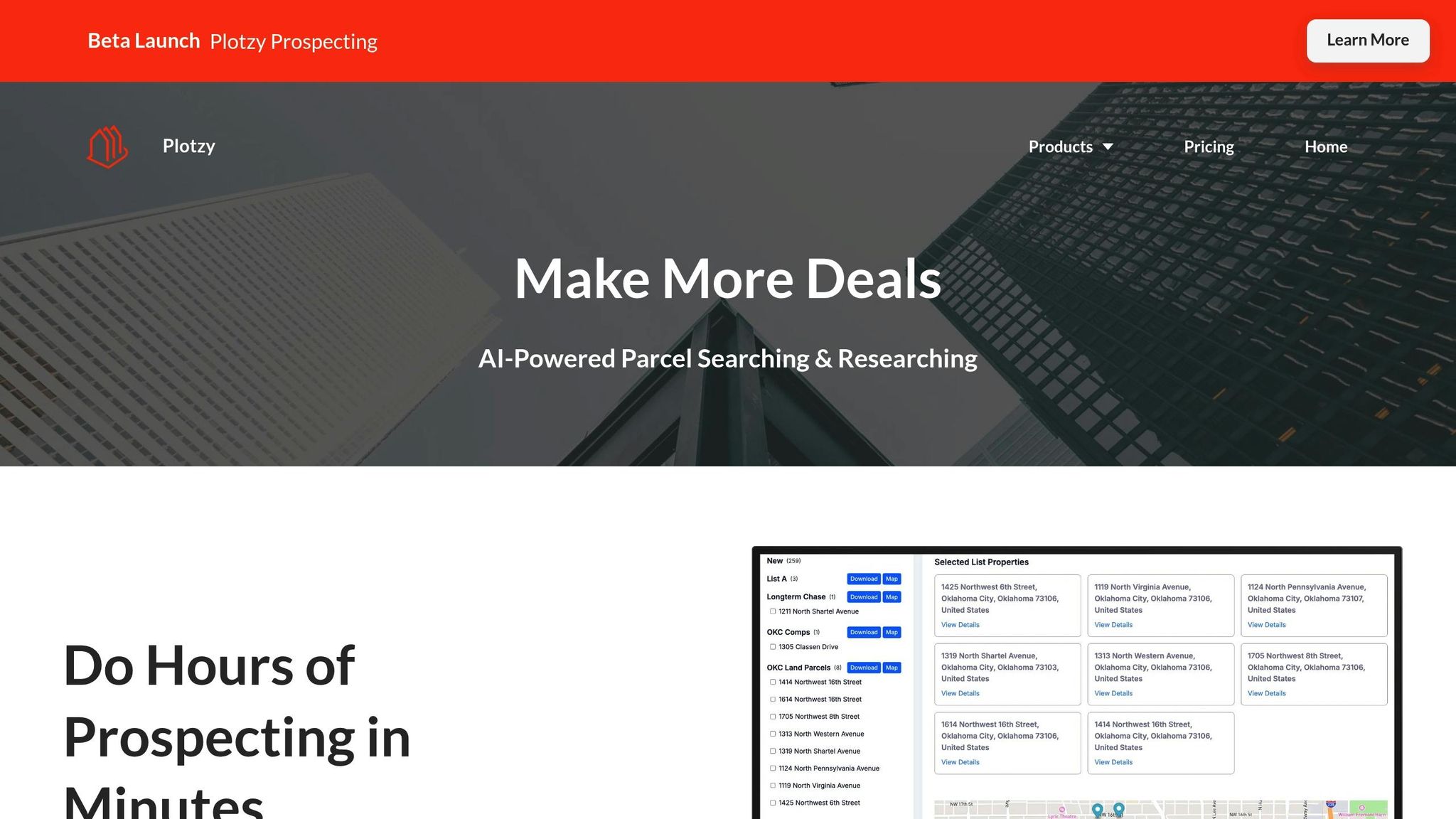

Plotzy's Features for Real Estate Professionals

Plotzy is a commercial real estate platform designed to simplify property research and analysis by consolidating data from multiple sources. It gathers parcel data, owner contact information, zoning regulations, and municipal records into one user-friendly interface. This makes it an invaluable tool for professionals managing complex real estate transactions.

Using RAG (Retrieval-Augmented Generation) technology, Plotzy ensures zoning compliance and verifies ownership details. For instance, if you're analyzing a contract and need to confirm zoning or ownership, Plotzy can instantly cross-reference this information with municipal records and tax assessor data, saving you time and reducing errors.

Here’s a quick look at some of Plotzy's standout features:

- Instant Zoning Checks: Quickly confirm regulatory compliance to ensure contracts align with local zoning laws.

- Filtering by Project Constraints: Narrow down parcels based on specific project requirements.

- Permitted Use Searches: Identify properties based on allowable uses, both by right and conditionally, which is crucial for development contracts.

- Comprehensive Public Records Access: Retrieve property details such as tax assessments, ownership history, and valuation data directly from public and county tax assessor records.

These capabilities not only enhance the efficiency of property research but also support risk scoring and report generation, ensuring a more thorough contract review process.

Benefits of Using Plotzy for Contract Risk Assessment

Plotzy's features translate into tangible benefits for real estate professionals, particularly when it comes to contract risk assessment. By streamlining property research, the platform reduces research time significantly - completing tasks in nearly half the time required by manual methods.

Another key advantage is its ability to centralize data. Plotzy provides direct access to owner contacts and municipal records, eliminating the need to switch between multiple databases. This accelerates deal closures and simplifies the verification of contract details.

For those handling portfolio acquisitions or multiple transactions, Plotzy's efficient organization and seamless data export capabilities are game-changers. You can maintain detailed records of your findings, ensuring consistency across all your risk assessments.

When contracts include unclear property descriptions or ownership details, Plotzy's access to municipal resources and custom shapefiles helps clarify what's being transferred and under what conditions. This minimizes data gaps and reduces the risk of oversight during contract reviews.

Summary Table of Plotzy's Key Features

| Feature | Contract Analysis Benefit | Pricing Plan |

|---|---|---|

| AI-Powered Parcel Search | Verify property descriptions and boundaries against official records | Basic ($65/month) & Pro ($200/month) |

| Owner Contact Information | Confirm current ownership and identify potential title issues | Both plans |

| Instant Zoning Answers | Check compliance with zoning regulations mentioned in contracts | Both plans |

| Permitted Use Search | Validate proposed development plans against zoning allowances | Both plans |

| Municipal Resource Access | Cross-reference contract terms with local government requirements | Pro plan |

| Custom Shapefiles | Overlay contract boundaries with official property maps | Pro plan |

| Data Export Capabilities | Generate comprehensive reports for due diligence documentation | Both plans |

Plotzy’s integrated approach ensures you’re not just reading through contract language - you’re actively validating claims and assumptions with accurate property data. This deeper level of analysis helps identify potential issues early, preventing costly mistakes down the line.

sbb-itb-11d231f

Compliance and Data Security in AI-Driven Risk Analysis

When AI systems are used to analyze real estate contracts, they process highly sensitive information. This makes strong compliance measures and robust data security practices absolutely crucial.

Following Regulatory Standards

The regulatory framework for AI in real estate is evolving quickly across the United States. While there’s no overarching federal law specifically governing AI, various state and local regulations fill the gap. Existing laws on privacy, intellectual property, and cybersecurity also apply to AI technologies used in contract analysis.

Some recent state laws highlight the growing focus on AI oversight. For example, Colorado’s AI Act, California’s AI Transparency Act, and Texas’s Responsible AI Governance Act - each set to take effect in early 2026 - stress the importance of compliance in areas like data privacy, cybersecurity, zoning, and intellectual property.

For real estate professionals leveraging AI for contract analysis, these regulations demand attention to several key areas: environmental compliance, safeguarding private data, adhering to zoning laws, and protecting intellectual property. Staying ahead of these evolving laws requires constant monitoring and ensuring that AI systems align with both current and emerging legal standards.

These legal requirements also bring into focus the critical challenge of securing sensitive data.

Data Privacy and Security Considerations

AI-driven contract analysis introduces notable security risks. Research shows that 80% of enterprise leaders view data leakage as a major concern, while 88% worry about potential manipulation of AI systems. These risks are especially significant in real estate, where contracts often include private financial details, property specifics, and personal information.

Matias Recchia, Co-Founder and CEO of Keyway, captures the gravity of the issue:

"A data breach in real estate could lead to significant financial losses, legal complications, and reputational damage."

To mitigate these risks, a multi-layered approach to security is essential. This includes implementing role-based access controls (RBAC) and multi-factor authentication (MFA) to limit unauthorized access to sensitive data. Encryption must be applied to protect data both during transmission and while stored, and secure APIs should be used for safe data exchange between systems.

The Cybersecurity and Infrastructure Security Agency (CISA) has outlined ten best practices specifically for AI systems. These include privacy-preserving techniques like data depersonalization and differential privacy, as well as regular risk assessments to identify vulnerabilities. Many firms are also adopting SOC 2 compliance standards, which serve as a benchmark for ensuring security and transparency in AI-driven data processing.

Another critical issue is how AI models handle client data. Preventing AI systems from using sensitive information for training is vital, especially since 92% of AI vendors claim extensive data usage rights, yet only 17% fully commit to regulatory compliance. This highlights the need for careful evaluation of AI vendors.

To enhance security, real estate firms should adopt permission-based access systems, ensuring that only authorized individuals can view sensitive documents. Maintaining immutable audit logs to track AI-generated analyses and applying zero trust principles can further strengthen defenses. Training employees to recognize AI-driven social engineering threats and fraud is equally important, along with using encrypted communication channels and strict access controls. Finally, regular AI audits and compliance reviews help ensure ethical decision-making while aligning with both company values and regulatory requirements.

Conclusion

AI is transforming contract risk analysis by automating complex assessments, minimizing human error, and speeding up deal processes. It simplifies the task of identifying risky clauses, compliance issues, and liabilities, all while improving efficiency and reducing legal risks.

With its ability to uncover risks that might go unnoticed during manual reviews - such as missing terms, zoning conflicts, financial liabilities, or gaps in ownership research - AI provides a significant advantage. By cross-referencing property details with zoning laws and regulatory databases, it can flag violations or inconsistencies that could potentially delay transactions.

Beyond mitigating risks, AI-driven tools like Plotzy enhance decision-making by bridging the gap between fast data processing and regulatory compliance. Plotzy’s platform integrates zoning checks, ownership verification, and comprehensive reporting, streamlining property research and improving due diligence.

However, these advancements also come with responsibilities. As regulations evolve, professionals must ensure that AI is used in compliance with legal standards. Robust data security measures are essential to safeguard sensitive information while maintaining the efficiency gains AI offers.

FAQs

How does AI help ensure real estate contracts comply with changing regulations?

AI plays a key role in keeping real estate contracts aligned with ever-evolving regulations. It does this by analyzing contracts against the latest zoning laws, property codes, and local requirements. These systems are built to stay current with regulatory updates, helping to minimize the chances of legal complications.

By automatically identifying potential compliance issues and sending alerts about new or revised rules, AI provides a forward-thinking approach to maintaining accurate and legally sound contracts. This allows stakeholders to focus on their transactions with added peace of mind.

What are the benefits of using AI to assess risks in real estate contracts?

How AI Enhances Risk Assessment in Real Estate Contracts

AI brings a new level of accuracy, speed, and efficiency to evaluating real estate contracts, far surpassing traditional methods. By automating the review process, it can quickly spot potential risks, flag key terms, and detect discrepancies. This not only saves time but also helps cut down on operational expenses.

Another advantage of AI is its ability to deliver data-driven insights. It reduces the likelihood of human error and bias, enabling professionals to make smarter, more informed decisions. This kind of proactive risk management can translate into stronger financial results and better-performing portfolios.

What’s more, AI is built to handle scale. Whether you’re dealing with complex agreements or a high volume of transactions, its capacity for scalable analysis makes it an indispensable asset in the real estate world.

How does AI ensure the privacy and security of sensitive data in real estate contracts?

AI systems place a strong emphasis on data privacy and security, implementing advanced protections throughout every phase - from gathering data to its final use. These protections often involve encryption, strict access controls, and frequent audits to block unauthorized access and keep sensitive information secure.

When it comes to real estate contract analysis, AI tools are developed with legal and ethical standards in mind. They align with privacy regulations to reduce risks such as data breaches, ensuring that confidential information remains protected while fostering trust and openness.