AI sentiment analysis is reshaping real estate by helping professionals identify off-market opportunities faster and more effectively. Here’s what you need to know:

- What it does: AI tools analyze emotions, opinions, and trends from text data like social media, zoning records, and reviews to uncover hidden market opportunities.

- Why it matters: Real estate pros using sentiment analysis find opportunities 2.7x faster and report 23% higher ROI compared to traditional methods.

- How it helps: Spot motivated sellers, neighborhood shifts, and market trends early by analyzing public sentiment patterns.

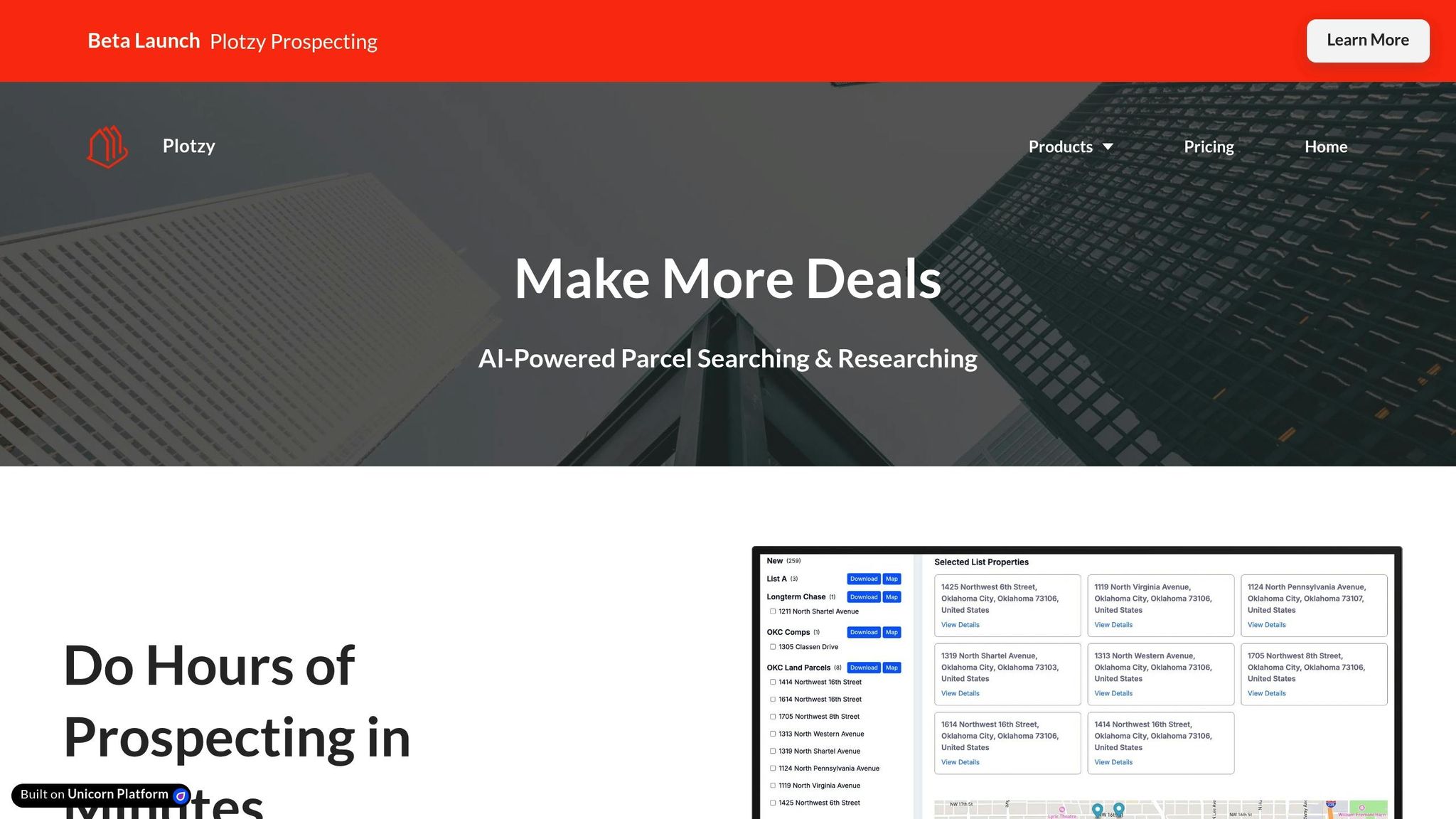

- Key tools: Advanced AI models like GPT-4 and platforms like Plotzy integrate sentiment insights with property data for smarter decision-making.

This technology is transforming how deals are sourced, enabling faster, data-driven decisions while staying ahead of competitors.

Using Sentiment Data to Find Off-Market Opportunities

Where to Find Sentiment Data in Real Estate

Real estate professionals have access to various sources of sentiment data that can reveal valuable market trends. For instance, municipal meeting transcripts capture public opinions on proposed developments, zoning changes, and neighborhood concerns. These documents often highlight how residents and businesses feel about specific areas, providing clues about shifting attitudes.

Zoning board discussions are another key resource. These debates often revolve around property use changes, variances, and new development proposals, offering insight into whether a neighborhood is becoming more open to growth or leaning toward resistance. Public records, such as permit applications, variance requests, and environmental impact statements, also shed light on stakeholder opinions and potential points of contention.

Online platforms like social media, local news comment sections, and neighborhood forums (e.g., Nextdoor) generate a steady stream of sentiment data. Reviews of local businesses, schools, and services can further reveal a neighborhood's reputation and how satisfied its residents are. Additionally, property-related news articles, market reports, and industry publications often contain language that AI tools can analyze to pinpoint emerging opportunities or challenges.

By tapping into these diverse data sources, real estate professionals can uncover actionable insights that lead to off-market opportunities.

Finding Deal Signals Through Sentiment Patterns

Once these sentiment data sources are in play, patterns within the data can offer clear signals about market shifts. For example, a gradual rise in negative sentiment around increasing mortgage rates might indicate a cooling market where sellers become more willing to negotiate on price. On the flip side, a spike in positive sentiment about a particular neighborhood could signal growing demand.

AI tools are particularly useful in detecting emotional trends that traditional metrics might miss. They can also identify potential partnerships or competitor activities by analyzing the language used in public statements, press releases, and regulatory filings.

Recent statistics highlight the growing role of sentiment analysis in commercial real estate. For example, 87% of CRE executives have expressed confidence in the market for the year ahead, and 59% plan to adopt AI tools in the coming year. These numbers underscore how sentiment-driven insights are becoming essential for staying competitive.

Case Example: Finding Hidden Deals with Sentiment Analysis

Take the example of McDonald's in 2004. That year, McDonald's UK profits hit a 30-year low due to negative publicity, which led to a major PR campaign. While this case comes from a different industry, it illustrates how early shifts in sentiment can signal opportunities - insights that are just as relevant in real estate.

By tracking sentiment changes, real estate professionals can spot trends, monitor competitor movements, and identify new markets. Setting up alerts for sudden shifts in sentiment around specific topics or locations can help them act quickly, often before opportunities become widely known.

For maximum impact, integrating sentiment analysis APIs with CRM systems and dashboards can combine sentiment scores with sales data, offering a more complete view of the market. When paired with traditional data, these insights empower professionals to seize off-market opportunities with confidence and speed.

AI Tools for Sentiment Analysis in Real Estate

Key Features of AI Sentiment Analysis Tools

AI-powered sentiment analysis tools rely on Natural Language Processing (NLP) to classify emotions within text, identifying nuances like anger, sarcasm, confidence, or frustration. These tools are designed to delve into the subtleties of language, making them highly effective in analyzing real estate data.

For real estate professionals, some standout features include real-time market sentiment tracking, which monitors conversations across various platforms simultaneously. These tools also provide insights into customer preferences, often revealing emerging trends before they fully take shape. Early detection of issues or opportunities gives users a competitive advantage, especially when pinpointing off-market deals.

Modern transformer models represent a leap forward in sentiment analysis. They excel at understanding context, subtle emotions, and the specialized language often used in real estate discussions. These models go beyond basic text analysis by examining MLS listings, incorporating economic indicators, and analyzing demographic trends to gauge overall market health. Additionally, AI tools now integrate data to assess investment risks, factoring in geographic and economic variables for a more comprehensive analysis.

How Plotzy Supports Sentiment-Driven Research

Plotzy takes these advanced capabilities further by integrating sentiment-driven insights into its property intelligence platform. Using Retrieval-Augmented Generation (RAG) technology, Plotzy delivers context-aware responses from specialized real estate datasets, simplifying complex tasks like zoning inquiries that often spark strong community reactions [doc].

For example, when sentiment analysis uncovers neighborhood concerns about zoning changes or new developments, Plotzy's zoning inquiry tool helps users quickly navigate local regulations. Professionals can search for properties based on permitted uses - either by right or conditionally - making it easier to address community resistance to specific types of projects.

Plotzy consolidates property data from multiple sources, offering a comprehensive perspective to validate sentiment-driven insights. For instance, access to owner contact details becomes crucial when sentiment analysis identifies potential sellers motivated by neighborhood or market shifts. Additionally, with features like parcel filtering and zoning layers, Plotzy allows users to visualize how community attitudes align with property characteristics. A review of 400,000 multifamily residential market reviews highlighted maintenance issues as a major concern for residents. Plotzy's detailed reports can help identify properties ripe for acquisition or improvement based on these sentiment-driven findings.

Adding Sentiment Insights to Your Decision-Making Process

Incorporating sentiment data into traditional metrics like sales figures can lead to smarter, more timely decisions. Real-time dashboards allow professionals to act on emerging opportunities, especially when negative sentiment coincides with property value drops of around 15%. These tools provide a clearer picture of whether sentiment trends are influencing actual market behavior.

For example, with 60% of buyers now factoring online reviews and social media engagement into their purchasing decisions, sentiment data has become a critical early indicator of demand changes. Working with data scientists to refine models tailored to real estate and local market conditions ensures even greater accuracy. Testing these tools on smaller deals before scaling up can also help fine-tune strategies.

AI tools now go beyond basic sales comparisons to offer negotiation intelligence, analyzing listing language, price changes, and time on market to gauge seller flexibility. Real-time metrics like inventory levels, days on market, and offer-to-list ratios provide additional context for bidding strategies. In one case study, an investment fund used natural language processing to scan foreclosure notices, court records, and news articles. This allowed them to identify distressed properties early, purchasing them at an average discount of 18% below AI-estimated market value.

To keep these tools effective, regular updates to sentiment models are essential as language and market conditions evolve. Training teams to interpret sentiment insights ensures users can maximize the value of these tools while remaining mindful of their limitations and potential biases.

Practical Uses of Sentiment Analysis in Off-Market Deals

Improving Property Research with Sentiment Insights

Sentiment analysis is reshaping property research by uncovering trends and patterns that traditional metrics often overlook. By diving into reviews, social media chatter, and online discussions, real estate professionals can pinpoint promising opportunities and steer clear of properties with red flags.

AI tools make it possible to sift through thousands of reviews at once, uncovering themes and sentiments that manual research would likely miss. This is especially helpful for multifamily properties or commercial spaces, where tenant satisfaction can significantly influence investment outcomes.

For instance, a study analyzing 400,000 reviews found that maintenance issues topped the list of concerns for residents in multifamily housing. This kind of insight allows investors to spot properties where operational challenges may signal an opportunity to negotiate off-market deals.

Sentiment analysis also helps identify underserved areas or market gaps. If data reveals repeated complaints about missing amenities in a neighborhood, developers can target properties there for acquisition and improvement projects. Additionally, sentiment data can flag neighborhood concerns about zoning changes or development plans, streamlining the search for off-market opportunities by highlighting areas of potential growth or risk.

Understanding Owner Intent Through Sentiment Trends

Beyond property research, sentiment trends offer a window into owner motivations. Just as buyer sentiment reflects confidence and emotional outlook, seller sentiment can hint at when owners might be ready to sell. These trends often provide early signals - sometimes months before a property officially hits the market.

Recent data shows a 5% rise in consumer sentiment and an 8% increase in the Small Business Optimism Index, both of which influence decisions about holding or selling assets. Higher sentiment typically aligns with increased demand and rising property values, while declining sentiment may signal a slowdown, prompting some owners to sell before values drop.

Social media platforms also hold valuable clues about owner intent. Posts about relocating, financial stress, or business changes can reveal a property owner's plans well ahead of formal listings. Since nearly 40% of property transactions now begin with digital communication - like text messages - analyzing these digital exchanges can provide early insights into seller motivations.

Better Prospecting Through Sentiment Mapping

Sentiment mapping takes the benefits of sentiment analysis even further, helping real estate professionals identify emerging investment opportunities. By analyzing neighborhood sentiment, AI tools can detect early signs of gentrification, infrastructure upgrades, or demographic shifts - factors that often signal rising property values.

This geographic approach ties community sentiment to market trends. For example, areas showing improving sentiment around local businesses, schools, or public projects often experience property value growth within 12-18 months. Spotting these trends early gives professionals a head start in contacting property owners before competition heats up.

Sentiment data is also invaluable for understanding tenant satisfaction, identifying emerging hotspots, or gauging public sentiment about specific locations. For commercial real estate professionals, this information can guide efforts to target specific property types or tenant categories.

Combining sentiment mapping with traditional market analysis strengthens prospecting efforts. For instance, Smartzip used AI to predict 72% of listings last year by analyzing market trends alongside sentiment data. This approach allows professionals to focus their efforts on high-potential areas, rather than spreading resources too thin.

Real-time sentiment tracking can further refine prospecting strategies. By monitoring social media feeds, professionals can quickly respond to shifts in public opinion or market sentiment. Acting on these rapid changes can open doors to new opportunities.

"Those psychological dimensions can play a big role in people's decision-making, and can really influence commercial real estate." - John Chang, National Director of Research and Advisory Services, Marcus & Millichap

While sentiment analysis offers powerful tools, it's essential to approach it ethically. Professionals must adhere to data compliance regulations and ethical scraping practices. This ensures sustainable access to sentiment data while maintaining professional integrity and legal compliance.

sbb-itb-11d231f

Ethics and Accuracy in Sentiment Analysis

Protecting Data Privacy and Following Compliance Rules

Real estate professionals are increasingly faced with the challenge of navigating the evolving landscape of U.S. data privacy laws. In 2023, five states - California, Utah, Colorado, Connecticut, and Virginia - introduced new regulations requiring companies to handle personal data with exceptional care. This is especially critical when analyzing sentiment from social media posts, online reviews, and other digital sources. For tasks like off-market deal analysis, adhering to these practices not only protects data integrity but also ensures a competitive edge in the market.

A case from November 2024 serves as a stark reminder of the consequences of failing to meet ethical standards. SafeRent Solutions settled for $2.3 million after allegations that its AI-powered tenant screening system discriminated against low-income applicants, particularly Black and Hispanic individuals relying on housing vouchers. This underscores the legal and ethical risks associated with mismanaged AI tools in real estate.

To maintain compliance and promote ethical AI use, companies should:

- Encrypt and anonymize personal data to protect individual privacy.

- Clearly disclose data collection practices and ensure transparency about AI involvement, such as tagging AI-generated emails or correspondence.

- Provide consumers with easy access to their personal data, allowing them to correct inaccuracies or request deletion.

- Implement GDPR oversight and maintain detailed documentation of AI processes.

These measures, paired with robust risk management strategies, demonstrate responsible data handling. However, protecting privacy is only one piece of the puzzle - addressing AI bias is equally critical.

Reducing Bias in AI Models

Bias in AI systems presents a significant challenge in real estate sentiment analysis. Whether it stems from unbalanced training data, flawed algorithms, or human oversight during development, bias can lead to discriminatory outcomes that harm individuals and expose companies to potential legal repercussions.

High-profile cases involving Amazon, iTutorGroup, and COMPAS highlight how imbalanced datasets and poor design can result in discriminatory AI behaviors. These examples emphasize the importance of careful model development in the real estate sector.

To reduce bias in sentiment analysis, real estate professionals can adopt several strategies:

- Pre-processing data: Modify training datasets to ensure they include diverse and representative samples. This helps models account for differences across demographic groups, geographic locations, and property types.

- In-processing adjustments: Incorporate fairness objectives directly into the algorithm during training.

- Post-processing refinements: Review and adjust outputs to ensure fairness after predictions are made.

Another key factor is building diverse teams. Teams with varied backgrounds are better equipped to spot patterns of bias that homogeneous groups might overlook. Regular audits and testing of AI models further help identify and resolve bias issues early.

"Bias often occurs in data when it is collected in a non-representative way – for example, by failing to ensure that there is an adequate balance between genders, age groups or ethnic groups in the sample."

- Bernard Marr, Contributor, Forbes

While fairness is crucial, ensuring the accuracy of sentiment analysis is just as important for making sound decisions.

Checking Sentiment-Driven Insights for Accuracy

Accuracy in sentiment analysis is essential because errors can lead to costly mistakes. While sentiment analysis is 75% more effective than traditional metrics at predicting investment trends, robust verification processes are necessary to ensure reliability.

To improve accuracy, real estate professionals should:

- Verify that data sources, such as social media posts and reviews, are credible and up to date.

- Cross-check sentiment insights with other data sources and expert opinions to build a more dependable foundation for decision-making.

Traditional metrics like price action and technical analysis provide a basic market overview, but sentiment analysis goes deeper. By capturing nuances in tone, language, and intent, it offers a richer understanding of market dynamics. For instance, advanced sentiment analysis has helped real estate companies achieve a 5–7% increase in operating income. Machine learning-based valuation models have also reduced absolute percentage errors by 18.4% compared to traditional methods.

Visual tools like sentiment maps, charts, and graphs can further enhance understanding, allowing professionals to interpret market signals and trends more effectively. Companies that integrate these insights not only improve operational performance but also boost customer satisfaction and reduce complaints.

Transfer learning models, which leverage pre-trained algorithms, have shown classification accuracies 20 percentage points higher than those using simpler lexicon-based approaches. However, these sophisticated tools require rigorous verification and human oversight to maximize their potential. When done right, accurate sentiment analysis equips real estate professionals with the confidence to identify and act on off-market opportunities effectively.

Sentiment Analysis, Relationship Building, & Real Estate Investing | The Really Rich Podcast - Ep.15

Conclusion: Changing Off-Market Deal Prospecting with AI

AI sentiment analysis is transforming how off-market deals are sourced, offering real estate professionals new tools to uncover opportunities and sharpen their competitive edge.

Key Advantages of AI-Driven Sentiment Analysis

One of the standout benefits? A 31% boost in investment returns thanks to AI’s ability to process unconventional data sources like public records and social media - areas that traditional methods often miss.

AI also brings a new level of precision to property valuations. Automated valuation models have a median error rate of less than 4.5% in established markets, compared to traditional appraisals, which range from 5-8%. This accuracy translates into financial wins: investors using AI-driven tools have secured purchase prices 3.7% below market averages, according to a National Association of Realtors study.

Efficiency gains are equally impressive. Cushman & Wakefield reported saving 550 hours every month through automated data capture, while CAPE Analytics helped clients reduce manual inspections by up to 50%, improving valuation accuracy by 7.7%.

On the competitive intelligence front, sentiment analysis allows real estate professionals to pinpoint homeowners most likely to list their properties soon. These capabilities are redefining how the industry approaches research, forecasting, and deal-making.

The Future of AI in Real Estate Research

AI’s role in real estate is expanding rapidly. In fact, the global generative AI market for real estate, valued at $437.65 million in 2024, is projected to grow to $1.3 billion by 2034, with an annual growth rate exceeding 11%. This growth reflects the technology’s proven ability to enhance operations, improve tenant retention, and drive smarter investments - factors that McKinsey research links to a 10% profit increase for companies adopting generative AI.

Adoption is accelerating across the industry. According to the 2024 New Delta Media Survey, 75% of top U.S. brokerages already rely on AI tools. This shift signals that AI is no longer experimental - it’s now a core part of real estate operations.

"Data - and use of that data to create strategic distance - are the new terrain on which businesses will compete for investor dollars, tenants, buyers, and longevity." – Matt Fitzpatrick and Vaibhav Gujral, Senior Partners at McKinsey

Leading platforms are integrating advanced AI capabilities, enabling users to filter properties by zoning, access owner contact details, and generate detailed reports. This evolution has moved the industry from simple property searches to comprehensive market intelligence platforms that combine sentiment analysis with traditional research.

AI’s future in real estate will rely on integrating multiple technologies. Generative AI, for example, adds creative problem-solving to the mix, complementing analytical AI’s strength in identifying patterns. Together, these tools offer a balanced approach to tackling both routine analyses and unique challenges.

Predictive analytics is another area poised for growth. By analyzing data from diverse sources - like property listings, economic indicators, and even social media - AI can help professionals forecast trends, identify high-growth areas, and fine-tune portfolios with unmatched precision.

For professionals eager to harness these advancements, starting small with focused pilot projects is key. As Raj Singh, Managing Partner at JLL Spark, emphasizes, "The key to making the leap from pilots to successful products hinges on data quality, workflow integration, and intuitive output interfaces".

The future of off-market deal prospecting belongs to those who can skillfully leverage AI tools to uncover hidden opportunities, make informed decisions, and stay ahead in an ever-evolving marketplace.

FAQs

How does AI sentiment analysis help uncover off-market real estate opportunities more efficiently?

AI sentiment analysis makes it easier to spot off-market real estate opportunities by sifting through massive amounts of unstructured data. Think social media posts, local news stories, or even community discussions. By leveraging natural language processing and machine learning, AI identifies patterns and signals - like hints of a property sale or shifts in tenant behavior - that could suggest a property might hit the market before it's officially listed.

This gives real estate professionals a head start, letting them act quickly on new leads, spot hidden trends, and discover untapped micro-markets. With its ability to boost both speed and precision, AI-powered sentiment analysis equips investors and brokers with the insights they need to make smarter, data-backed decisions in an ever-competitive market.

What are the best sources of sentiment data for identifying trends and changes in the real estate market?

The best places to gather sentiment data for monitoring real estate trends include social media platforms, news articles, consumer surveys, and feedback tools. These channels help capture public opinion, gauge market sentiment, and identify emerging patterns, giving you a clearer picture of potential changes in the real estate market.

Take consumer surveys, for instance. Tools like the Home Purchase Sentiment Index (HPSI) offer a quick look at how confident buyers feel about the housing market. Meanwhile, social media and news articles provide a pulse on real-time reactions to market developments. When paired with AI analysis, these data sources can reveal actionable insights to help you stay competitive in the fast-moving real estate world.

What ethical considerations should be addressed when using AI for sentiment analysis in real estate?

Real estate professionals using AI for sentiment analysis must carefully address ethical challenges to uphold fairness and transparency. One major issue is algorithmic bias. AI systems trained on biased historical data can unintentionally reinforce discrimination, particularly in property evaluations or decision-making processes. To counter this, it's crucial to validate and continuously monitor these systems to reduce such risks.

Another pressing concern is data privacy. Handling data responsibly is non-negotiable, especially when complying with laws like the Fair Housing Act and similar regulations. Being transparent about how AI tools process and analyze data is essential for building and maintaining trust with clients and stakeholders.

Finally, accountability plays a significant role in AI-driven decisions. Real estate professionals must oversee these tools and take full responsibility for their outcomes, ensuring that they align with ethical principles and adhere to industry best practices.